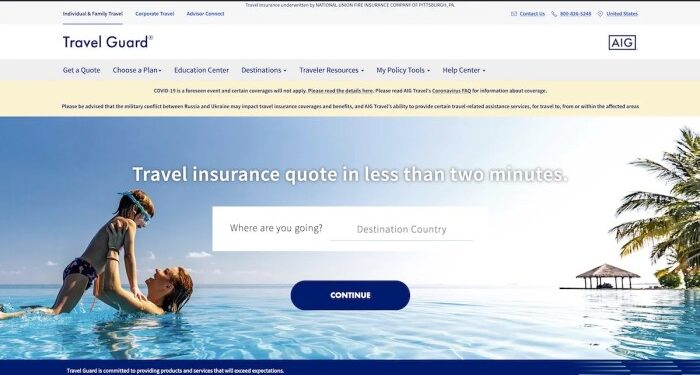

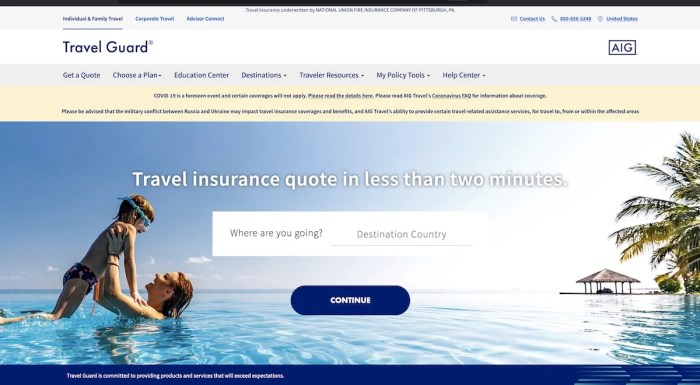

Embark on a journey with TravelGuard, a comprehensive travel protection service that ensures peace of mind for travelers. From unexpected emergencies to unforeseen circumstances, TravelGuard is here to safeguard your adventures. Let's delve into the world of travel protection and discover how TravelGuard can be your trusted companion on every trip.

In this guide, we'll explore the different types of plans, benefits, coverage details, and the claim process with TravelGuard. Get ready to elevate your travel experience with added security and support at every step of the way.

Introduction to TravelGuard

TravelGuard is a comprehensive travel insurance provider that offers various services to protect travelers from unforeseen events and emergencies during their trips. Whether it's a medical emergency, trip cancellation, lost baggage, or any other unexpected situation, TravelGuard aims to provide assistance and financial coverage to ensure peace of mind for travelers.

Services Offered by TravelGuard

- Emergency medical assistance and evacuation

- Trip cancellation and interruption coverage

- Baggage loss or delay reimbursement

- 24/7 travel assistance services

- Coverage for travel delays and missed connections

Examples of Situations where TravelGuard can be Beneficial for Travelers

- Imagine your flight gets cancelled due to severe weather conditions, and you need to rebook your tickets last minute. TravelGuard can help cover the additional costs incurred.

- If you fall ill during your trip and require medical attention, TravelGuard can assist in arranging emergency medical services and cover the expenses.

- In the unfortunate event of losing your luggage or having it delayed, TravelGuard can reimburse you for the essential items you need to purchase during the wait.

Types of TravelGuard Plans

When it comes to TravelGuard plans, there are several options available to cater to different travel needs. Each plan offers a unique set of coverages and benefits, so it's essential to understand the differences to choose the most suitable one for your trip.

Basic Plan

The Basic Plan typically offers coverage for essential travel concerns such as trip cancellation, trip interruption, and emergency medical expenses. It provides a good level of protection at an affordable price, making it suitable for budget-conscious travelers.

Silver Plan

The Silver Plan builds upon the Basic Plan by offering additional coverages like baggage loss/delay, travel delay, and rental car damage. This plan is ideal for travelers who want a bit more comprehensive coverage without breaking the bank.

Gold Plan

The Gold Plan is the most comprehensive option, providing extensive coverage for a wide range of travel mishaps. In addition to the coverages offered in the Basic and Silver Plans, it may include benefits like emergency medical transportation, pre-existing medical condition coverage, and concierge services.

Choosing the Right Plan

When selecting a TravelGuard plan, consider factors such as your destination, trip duration, activities planned, and budget. If you're embarking on a short domestic trip, the Basic Plan may suffice. For international travel or longer trips, the Silver or Gold Plan could offer more suitable coverage.

Benefits of TravelGuard

TravelGuard coverage offers a range of benefits to travelers, providing peace of mind and assistance in times of need. Whether facing a medical emergency or dealing with trip interruptions, TravelGuard can be a valuable resource for travelers.

Key Benefits of TravelGuard

- Emergency Medical Assistance: TravelGuard provides access to medical professionals and facilities in case of illness or injury during travel.

- Trip Cancellation/Interruption Coverage: Reimburses non-refundable expenses if a trip is canceled or cut short due to covered reasons.

- Lost or Delayed Baggage Reimbursement: Offers compensation for lost, stolen, or delayed luggage during travel.

- 24/7 Travel Assistance: Provides round-the-clock support for travel-related emergencies or inquiries.

Real-Life Examples of TravelGuard Benefits

"During a recent trip, Sarah fell ill and required hospitalization. Thanks to TravelGuard, she received prompt medical attention and coverage for her medical expenses, allowing her to continue her trip once recovered."

"When John's flight was canceled due to severe weather, TravelGuard helped him rebook his flight and provided compensation for his additional expenses, ensuring he reached his destination without further hassle."

How to Purchase TravelGuard

When it comes to purchasing a TravelGuard plan, there are a few key steps to consider to ensure you select the right coverage for your needs.

Process of Purchasing a TravelGuard Plan

- Start by researching different TravelGuard plans available to find one that aligns with your travel requirements, such as trip duration, destination, and activities planned.

- Compare the coverage and benefits offered by each plan to determine which one provides the best value for your specific trip.

- Once you have selected a plan, visit the official TravelGuard website or contact a licensed insurance agent to start the purchasing process.

- Provide the necessary information about your trip, such as travel dates, destination, and any additional coverage options you may require.

- Review the policy details carefully before making the payment to ensure you understand the coverage limits, exclusions, and claims process.

- Complete the purchase by making the payment online or through the insurance agent, and make sure to keep a copy of your policy documents for reference during your trip.

Considerations Before Buying a Plan

- Assess your travel needs and risks to determine the level of coverage required, such as medical emergencies, trip cancellations, or lost baggage.

- Check if your existing insurance policies or credit card benefits already provide some coverage for travel-related issues to avoid overlapping coverage.

- Read reviews and testimonials from other travelers who have used TravelGuard plans to gauge the reliability and customer service of the insurance provider.

- Consider any pre-existing medical conditions or activities not covered by standard plans and inquire about customizing your policy to include these specific needs.

Where to Purchase TravelGuard Plans

- You can purchase TravelGuard plans directly from the official website, where you can compare different plans, get quotes, and complete the purchase online.

- Alternatively, you can contact licensed insurance agents who offer TravelGuard plans to receive personalized assistance in selecting the right coverage for your trip.

- Some travel agencies or tour operators may also offer TravelGuard plans as part of their travel packages, providing a convenient option to purchase insurance along with booking your trip.

TravelGuard Coverage Details

TravelGuard offers comprehensive coverage for various aspects of travel, providing peace of mind to travelers in case of unforeseen events. Let's explore in-depth the coverage details provided by TravelGuard, including any exclusions or limitations, along with examples of scenarios where TravelGuard coverage proved to be essential.

Coverage Details:

- Trip Cancellation and Interruption Coverage: This includes reimbursement for non-refundable trip expenses if you have to cancel or cut short your trip due to covered reasons such as illness, injury, or severe weather conditions.

- Emergency Medical and Dental Coverage: TravelGuard provides coverage for emergency medical and dental expenses incurred during your trip, ensuring you receive necessary treatment without worrying about high costs.

- Baggage Loss and Delay Coverage: In case your baggage is lost, damaged, or delayed during your trip, TravelGuard offers coverage for the replacement of essential items until your baggage is returned.

Exclusions and Limitations:

- Pre-existing Medical Conditions: TravelGuard may have limitations or exclusions related to pre-existing medical conditions, so it's important to review the policy details carefully before purchasing.

- High-Risk Activities: Coverage for certain high-risk activities such as extreme sports or participation in dangerous events may not be included in standard plans, requiring additional coverage.

- Country-Specific Limitations: Some countries or regions may have limitations on coverage based on their level of risk or political stability, so it's essential to check the policy for any restrictions.

Essential Scenarios:

- Medical Emergency Abroad: Imagine falling ill or getting injured during your trip and requiring immediate medical attention. TravelGuard coverage would ensure you receive necessary treatment without worrying about expensive medical bills.

- Flight Cancellation Due to Severe Weather: If your flight gets canceled due to severe weather conditions, causing you to miss a connecting flight or important event, TravelGuard coverage would provide reimbursement for the incurred expenses.

- Lost Luggage: In a scenario where your luggage goes missing during a layover or transfer, leaving you without essential items, TravelGuard coverage would help cover the costs of replacing those items until your baggage is located.

Claim Process with TravelGuard

When it comes to filing a claim with TravelGuard, there are specific steps you need to follow to ensure a smooth and successful process. Understanding what documentation is required and knowing how to navigate the claim process can make a significant difference in getting your claim approved quickly.

Steps to File a Claim with TravelGuard

- Contact TravelGuard as soon as possible after the incident to report your claim.

- Provide all necessary documentation, such as police reports, medical records, receipts, and travel itineraries.

- Fill out the claim form accurately and completely to avoid delays in processing.

- Cooperate with any additional requests for information or documentation from the claims adjuster.

Documentation Required for Making a Claim

- Proof of travel insurance purchase.

- Original receipts for expenses related to the claim.

- Police reports, medical records, or other official documents supporting your claim.

- Copies of travel itineraries, tickets, and any other relevant travel documents.

Tips for a Smooth Claim Process

- Keep all receipts and documentation organized from the start of your trip.

- Contact TravelGuard immediately after an incident to start the claims process promptly.

- Be honest and provide accurate information when filing your claim.

- Follow up with TravelGuard regularly to check on the status of your claim and provide any additional information requested.

Last Point

As we conclude our exploration of TravelGuard, it's evident that having reliable travel protection is paramount for any globetrotter. With TravelGuard by your side, you can embrace new destinations with confidence, knowing that you have a safety net in place.

Whether it's a leisurely vacation or a business trip, TravelGuard offers peace of mind and assistance when you need it most. Stay protected, stay prepared with TravelGuard.

FAQ Section

Is TravelGuard suitable for international travel?

Yes, TravelGuard provides coverage for both domestic and international travel, offering assistance and protection wherever you go.

What types of emergencies does TravelGuard cover?

TravelGuard covers a wide range of emergencies such as trip cancellations, medical emergencies, lost luggage, and more. Check your plan for specific details.

Can I purchase TravelGuard for a single trip only?

Yes, TravelGuard offers single trip plans in addition to annual plans for frequent travelers. Choose the option that suits your travel needs.

How quickly can I file a claim with TravelGuard?

You can file a claim with TravelGuard as soon as you encounter an issue during your trip. Make sure to have all necessary documentation for a smooth process.

Are adventure sports covered by TravelGuard?

Some adventure sports may be covered by TravelGuard, but it's important to review the policy details to understand the extent of coverage for such activities.