Travel insurance compare sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In a world where unexpected events can disrupt even the most meticulously planned trips, finding the right travel insurance becomes paramount.

By comparing different policies, travelers can ensure they are adequately protected and can embark on their journeys with peace of mind.

Importance of Travel Insurance Comparison

When it comes to traveling, ensuring you have the right travel insurance coverage is essential for your peace of mind and protection. Comparing travel insurance policies is a crucial step in finding the best plan that suits your needs and budget.

Key Factors to Consider When Comparing Travel Insurance Plans

- Coverage Limits: Check the maximum coverage amount for medical emergencies, trip cancellations, and lost belongings.

- Policy Exclusions: Understand what is not covered by the insurance to avoid any surprises later on.

- Additional Benefits: Look for extra perks such as coverage for adventure activities, rental car protection, or emergency assistance services.

- Cost and Deductibles: Compare premiums and deductibles to find a balance between affordability and coverage.

- Customer Reviews: Read feedback from other travelers to gauge the reliability and customer service of the insurance provider.

Benefits of Finding the Right Coverage Through Comparison

- Cost-Effective: By comparing different insurance plans, you can find a policy that offers the best value for your money.

- Customized Coverage: Tailor your insurance to fit your specific travel needs, whether it's for a short weekend trip or a long international vacation.

- Piece of Mind: Knowing you have adequate coverage in case of emergencies or unforeseen events can help you relax and enjoy your travels worry-free.

Types of Travel Insurance to Compare

When comparing travel insurance options, it's important to understand the different types available and the coverage they provide. Here are some key types of travel insurance to consider:

1. Single-Trip Insurance

Single-trip insurance is designed to cover one specific trip, usually for a set period of time. This type of insurance typically includes coverage for medical emergencies, trip cancellation or interruption, baggage loss or delay, and other travel-related mishaps. It is ideal for travelers who take one or two trips a year.

2. Annual Multi-Trip Insurance

Annual multi-trip insurance, also known as annual travel insurance, provides coverage for multiple trips within a year. This type of policy is cost-effective for frequent travelers and offers similar coverage as single-trip insurance, but for an entire year. It usually includes medical coverage, trip cancellation, baggage loss, and other benefits that may vary depending on the provider.

3. Specialty Travel Insurance

Specialty travel insurance caters to specific needs or activities, such as adventure sports, business travel, or senior travel. These policies offer tailored coverage to address the unique risks associated with these activities, providing peace of mind for travelers engaging in specialized travel experiences.

4. Group Travel Insurance

Group travel insurance is designed for groups of travelers, such as families, friends, or corporate groups. It typically includes coverage for the entire group, offering benefits like medical expenses, trip cancellation, and emergency assistance. Group policies can be more cost-effective than individual plans for group travel arrangements.

5. Cruise Travel Insurance

Cruise travel insurance is tailored to cover specific risks associated with cruise vacations, such as trip interruptions, missed port departures, or onboard medical emergencies. These policies often include coverage for cruise-specific incidents, making them a valuable option for travelers embarking on cruise journeys.Consider the type of trip you are planning, the frequency of your travels, and any specific needs or activities involved to determine the most suitable travel insurance option for your journey.

Factors to Consider When Comparing Policies

When comparing travel insurance policies, it is crucial to evaluate various factors to ensure you choose the most suitable coverage for your needs. Consider the following essential factors to make an informed decision:

Coverage Limits

- Take note of the maximum coverage limits for medical expenses, trip cancellations, baggage loss, and other benefits offered by the policy.

- Ensure that the coverage limits align with your travel plans and provide adequate protection in case of emergencies.

Deductibles

- Understand the deductible amount you would need to pay out of pocket before the insurance coverage kicks in.

- Compare deductibles across different policies to determine the cost-sharing arrangement that best suits your budget and preferences.

Exclusions

- Review the list of exclusions in each policy to identify situations or events not covered by the insurance.

- Be aware of any exclusions related to pre-existing medical conditions, adventurous activities, or specific destinations you plan to visit.

Pre-existing Medical Conditions

- Consider whether the policy covers pre-existing medical conditions or requires a waiver for such conditions to be included in the coverage.

- Disclose any pre-existing conditions accurately to avoid claim denials due to non-disclosure.

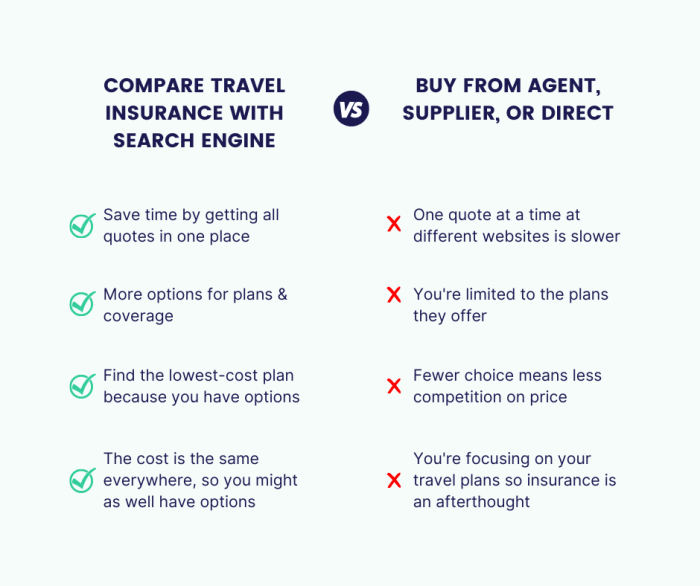

Tools and Resources for Travel Insurance Comparison

When it comes to comparing travel insurance policies, there are several tools and resources available to help you make an informed decision. These platforms can simplify the process and allow you to find the best policy that suits your needs and budget.

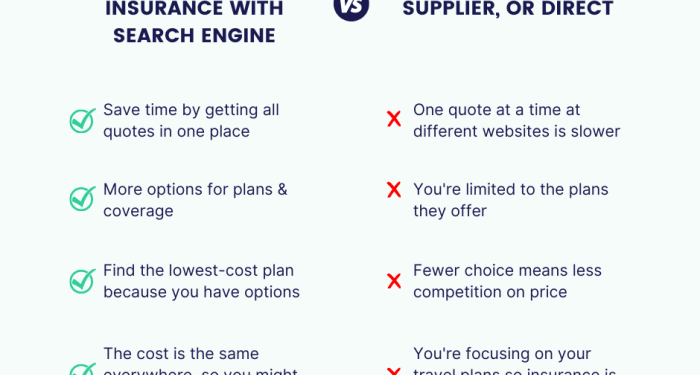

Online Comparison Platforms

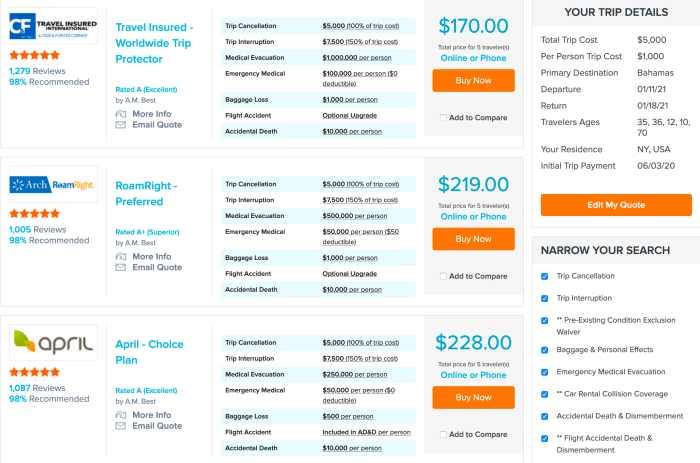

- There are various online platforms like InsureMyTrip, Squaremouth, and Compare the Market that allow you to compare multiple travel insurance policies in one place.

- These platforms typically require you to input details about your trip, such as destination, travel dates, and coverage preferences, to generate a list of suitable policies.

- Make sure to review the coverage details, exclusions, and premiums of each policy carefully to make an informed decision.

Tips for Using Comparison Tools Effectively

- Compare policies based on your specific needs, such as trip duration, destination, and activities planned during your travels.

- Consider factors like coverage limits, deductibles, medical coverage, trip cancellation benefits, and emergency assistance services.

- Look for customer reviews and ratings to gauge the reliability and customer service of the insurance providers.

Role of Insurance Brokers or Agents

- Insurance brokers or agents can also assist you in comparing travel insurance policies and finding the most suitable one for your trip.

- Brokers have access to a wide range of insurance products and can provide personalized recommendations based on your requirements.

- They can help you understand the fine print of policies, answer any questions you may have, and guide you through the claims process if needed.

Ultimate Conclusion

In conclusion, navigating the landscape of travel insurance comparison can be a game-changer for travelers seeking comprehensive coverage tailored to their specific needs. By understanding the importance of comparing policies, exploring different types of insurance, considering essential factors, and utilizing the right tools, travelers can make informed decisions that enhance their travel experiences.

Start your journey today with the confidence that comes from knowing you have the best travel insurance coverage in place.

Expert Answers

What are the key factors to consider when comparing travel insurance plans?

When comparing travel insurance plans, it's essential to look at coverage limits, deductibles, exclusions, and additional benefits like emergency assistance services.

How do single-trip insurance and annual multi-trip insurance differ?

Single-trip insurance provides coverage for one specific trip, while annual multi-trip insurance covers multiple trips within a year. The latter can be more cost-effective for frequent travelers.

What role do insurance brokers or agents play in assisting with policy comparison?

Insurance brokers or agents can provide personalized recommendations, explain complex policy details, and help travelers navigate the comparison process to find the most suitable coverage.